What the 2024 EREF Report Says About U.S. Landfill Costs

The Environmental Research & Education Foundation (EREF) has released its annual “Analysis of MSW Landfill Tipping Fees — 2024”, providing the most comprehensive look yet at how much it costs to dispose of municipal solid waste (MSW) across the United States.

📄 Download the full report directly from EREF: https://erefdn.org

Why Tipping Fees Matter

Tipping fees—sometimes called gate rates—represent the per-ton cost to dispose of waste at a landfill. While they’re often discussed in the context of municipal budgets, these fees also drive commercial and industrial waste management decisions. Higher tipping fees encourage recycling, waste reduction, and alternative reuse options, while low fees can make disposal more economically attractive than recovery.

In 2024, EREF surveyed 494 active landfills nationwide and received fee data from 351 facilities, producing one of the most detailed pictures of disposal pricing available in the United States.

National Trends: Landfill Costs Climb 10 Percent in One Year

EREF reports that the average U.S. landfill tipping fee increased by 10 % in 2024, rising from $56.80 per ton in 2023 to $62.28 per ton. When weighted by tonnage (so larger landfills count more), the average reached $62.63 per ton—a $5 increase over 2023.

That marks the largest single-year jump since 2022, and it means landfill disposal costs have grown nearly 30 % since 2016 in inflation-adjusted terms.

Behind the increase are inflationary pressures, higher labor costs, and stricter operational requirements. EREF found a strong statistical correlation between landfill tip fees and key national economic indicators such as the Consumer Price Index (CPI), vehicle maintenance costs, and wages. In 2024, the CPI-to-tipping-fee correlation reached R² = 0.82, suggesting that general inflation remains the dominant driver of disposal costs.

📉 Beat the 2025 Tipping Fee Hikes

Landfill rates are climbing, but your operational costs don't have to. The most effective way to lower your waste bill is Landfill Diversion.

Waste Optima finds alternative reuse outlets that are often 30-50% cheaper than the dump.

- Audit your current waste spend.

- Divert heavy tonnage to recycling/reuse markets.

- Lock in stable pricing unaffected by landfill taxes.

Large Landfills Now Charge the Most

For the first time since EREF began tracking, large landfills (handling > 390,000 tons per year) consistently charge more than smaller sites.

Large: $70.62 per ton

Medium: $56.98 per ton

Small: $64.41 per ton

Large facilities manage 56 % of all U.S. MSW but now set the price ceiling. Their higher fees reflect capital-intensive gas-collection systems, host-community payments, and post-closure liabilities. Smaller landfills often benefit from municipal ownership or subsidies that keep rates lower.

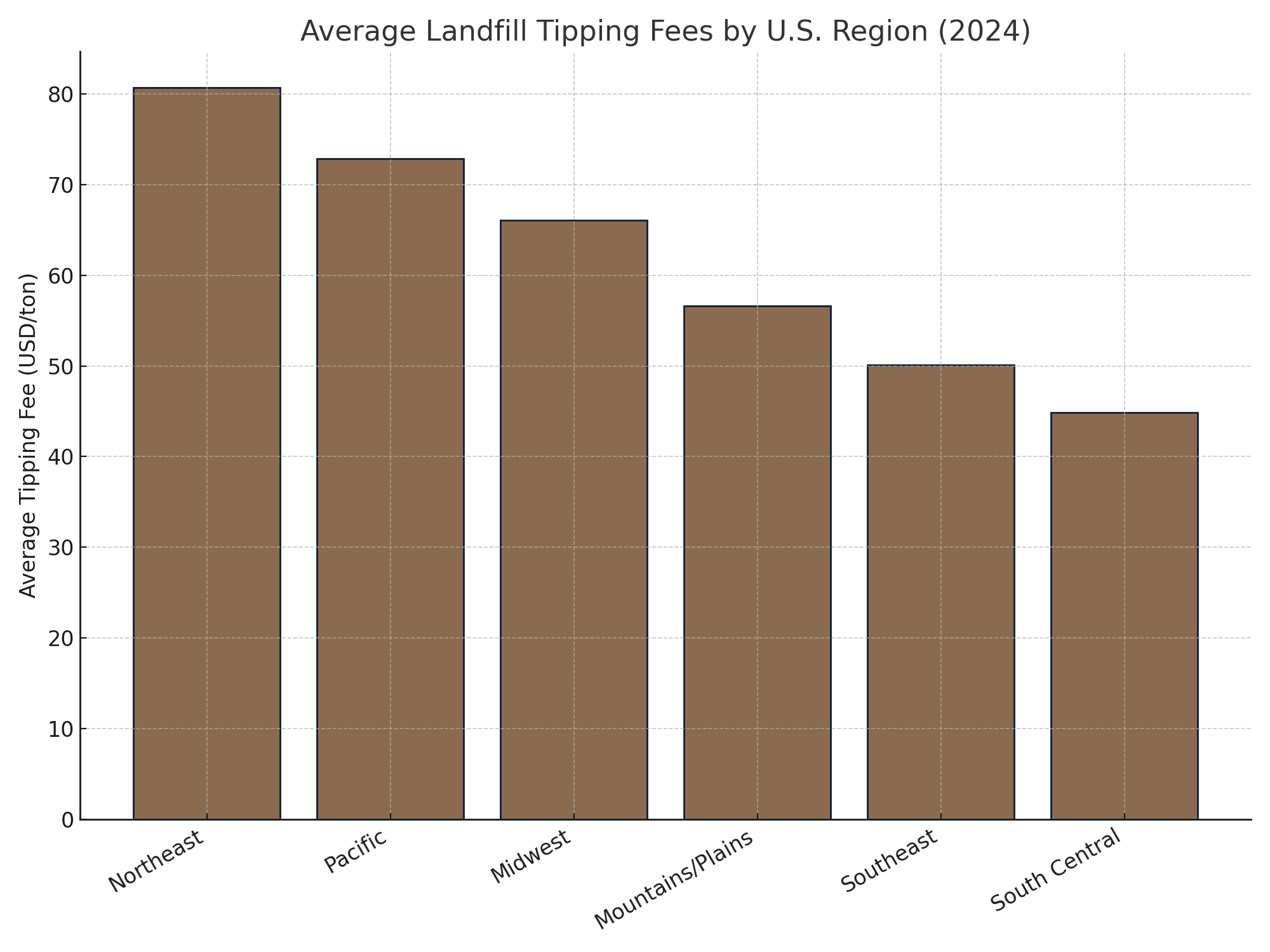

Regional Differences: Northeast Still the Most Expensive

The Northeast continues to lead the nation with the highest landfill tipping fees, averaging $80.67 per ton, followed by the Pacific region at $72.88. At the other end of the spectrum, the South Central region (Arkansas, Louisiana, New Mexico, Oklahoma, Texas) averages just $44.87 per ton.

Regional averages for 2024:

The steepest regional jump occurred in the Pacific, where landfill fees surged 17 % in one year—driven by rising costs in California and Hawaii. Meanwhile, the Northeast’s slight decline likely reflects stabilization after years of above-average increases.

State-by-State Insights

EREF’s Appendix A2 lists detailed state averages based on October 2024 surveys. Highlights include:

Highest tipping fee: Alaska – $124.25/ton, reflecting remote operations and high transport costs.

Lowest tipping fee: Kansas – $34.78/ton, thanks to abundant landfill capacity.

Typical range: Most states fall between $45 and $85 per ton.

National mean: $62.28 ± $35.98 per ton.

Waste-to-Energy (WTE) states consistently report higher landfill rates—$71.28/ton compared with $55.57/ton for non-WTE states—a 28 % premium tied to stricter disposal regulations and higher recycling participation.

Public vs. Private Landfills: A 34 % Price Gap

Private landfills (34 % of the total surveyed) now average $74.75 per ton, compared to $55.89 per ton at public sites—a 34 % difference. Private operators manage roughly 62 % of national MSW tonnage, often incorporating host-community fees and profit margins into their pricing structures, while public facilities frequently subsidize costs through tax revenue or recycling surcharges.

Construction & Demolition Waste Nearly Equals MSW Rates

Landfills accepting construction and demolition (C&D) materials charged an average of $65.84 per ton in 2024—only slightly higher than the MSW average of $62.28.

Over half (55 %) of surveyed landfills charged identical rates for both waste streams, suggesting C&D pricing is now effectively converging with MSW in many markets.

Emerging Waste Streams: Solar Panels and Wind Turbine Blades

For the first time, EREF analyzed disposal fees for renewable-energy equipment, reflecting growing end-of-life volumes from solar and wind infrastructure.

Average reported tipping fees:

Solar panels: $63.34 per ton

Wind-turbine blades: $68.40 per ton

Oklahoma reported the highest costs ($125 for solar panels), while Texas reported the lowest ($40.94 for solar, $36.27 for wind). Many facilities require panels or blades to be cut to manageable sizes or screened for hazardous components before acceptance.

Economic Correlations: Inflation, Vehicles, and Wages

EREF’s regression analysis showed a strong link between inflation and landfill pricing—especially for labor costs, where the relationship reached an R² of 0.85.

As wages, equipment maintenance, and fuel prices rise, landfill operators face mounting overhead. The result: higher tipping fees nationwide. The data reinforces that waste-sector pricing behaves much like other capital- and labor-intensive industries—it tracks inflation closely but adjusts slowly downward.

What This Means for Businesses

For manufacturers, logistics companies, and other industrial generators, these trends underline the importance of landfill diversion strategies. When landfill rates rise, recycling, by-product reuse, and waste-to-value programs become more competitive. Companies can improve margins—and sustainability performance—by diverting materials into beneficial reuse streams before they hit the landfill gate.

As the EREF report shows, disposal costs vary widely by region, ownership type, and even waste category. Understanding these dynamics helps businesses negotiate smarter hauling contracts, benchmark sustainability programs, and identify cost-saving diversion opportunities.

Key Takeaway

Landfill disposal in the U.S. is getting steadily more expensive—and more uneven. The EREF 2024 report shows that rising operational costs, inflation, and regional disparities are reshaping the waste landscape. For industrial generators, it’s another reason to rethink waste as a resource, not a liability.

Download the Full Report

📘 Source: Environmental Research & Education Foundation (2025).

“Analysis of MSW Landfill Tipping Fees — 2024.”

Available at www.erefdn.org

© 2025 EREF. Used with citation for educational purposes.